What to Consider Before Selecting an Online Forex Trading Platform

Foreign exchange (Forex) trading is one of the most popular and lucrative investment opportunities for traders today. With the advent of the internet, online Forex trading has become very popular, which has led to the emergence of numerous online Forex brokers. However, not all brokers are reputable and secure, which makes choosing a broker a daunting task. In this blog post, we will guide you on how to choose a reputable and secure online Forex broker.

1. Regulation and License: The first step is to check the regulation of the prospective broker. It is essential to choose a broker that is regulated and licensed by a reputable regulatory body in the country of operation. You can check the regulatory body from the broker’s website, and ensure that the regulatory body has strict rules and compensation schemes for clients. Regulated brokers are more secure and protect the client’s investment.

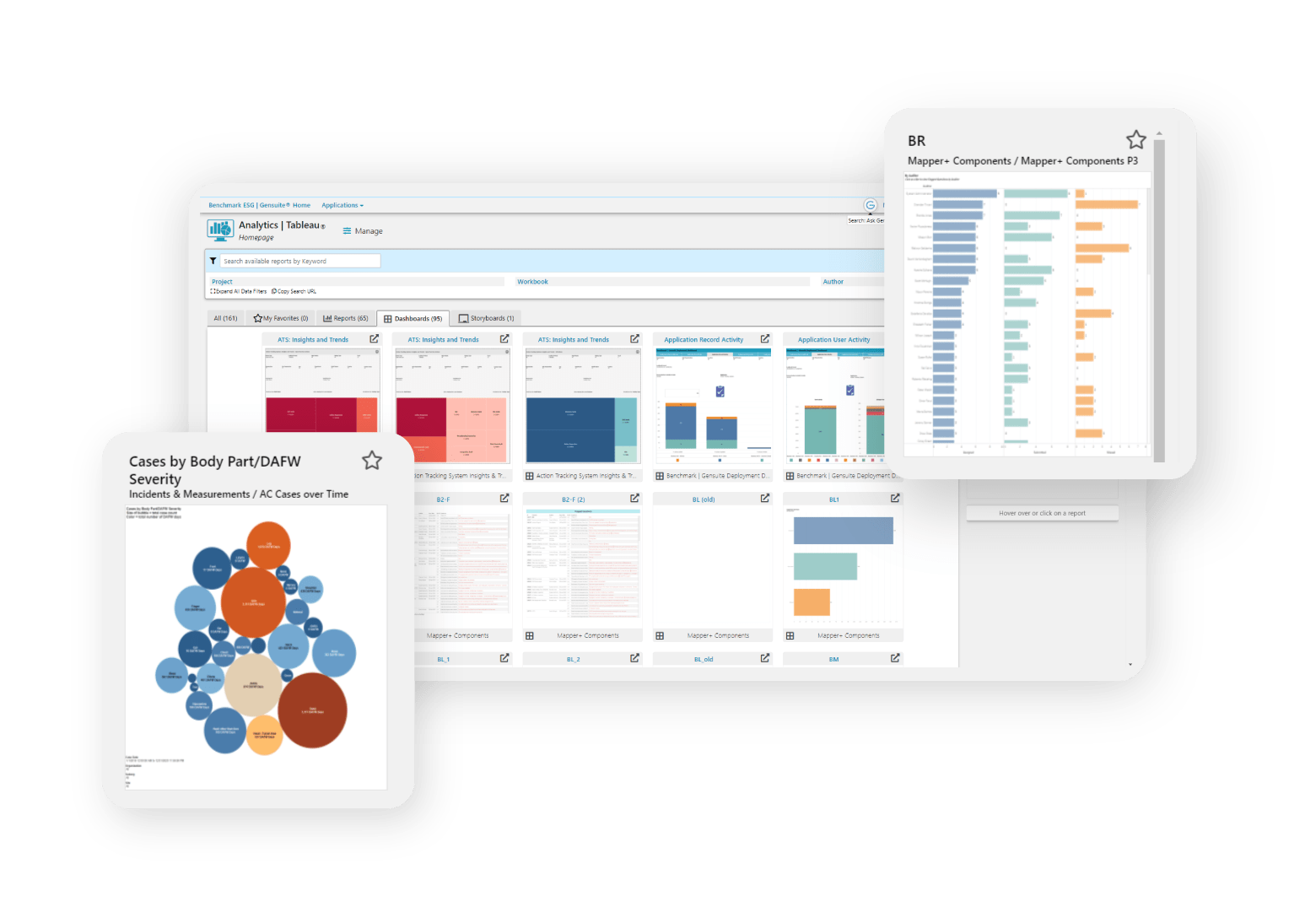

2. Trading platforms: The trading platform is the broker’s portal to the Forex market. Therefore, it is important to choose a broker that offers a trading platform that is user-friendly, efficient, and meets your trading needs. The trading platform should have essential features such as technical analysis tools, real-time quotes, and one-click trading. Additionally, you should check the compatibility of the platform with your computer or mobile device.

3. Customer support: A reputable Forex broker should offer excellent customer support. This includes multiple support channels such as email, phone, and live chat. The support team should be knowledgeable, professional, and readily available 24/7 to assist you with any issues. Before choosing a broker, test their customer support by asking them several questions and assessing their response.

4. Spreads and commissions: Another important factor to consider is the broker’s spreads and commissions. This is the cost of trading with the broker, and it can affect the profitability of your trades. The spreads and commissions vary between brokers, with some having fixed spreads, while others have variable spreads. It is advisable to choose a broker that offers competitive spreads and low commissions.

5. Deposit and withdrawal options: You should also consider the deposit and withdrawal options offered by the broker. The broker should offer a wide range of payment methods such as credit/debit cards, bank transfers, e-wallets, and cryptocurrencies. The process of depositing and withdrawing funds should be fast, secure, and transparent. Additionally, you should check if the broker charges any fees or commissions on deposits and withdrawals.

Choosing a reputable and secure online Forex broker is crucial to your investment success. It is essential to check the broker’s regulation, trading platforms, customer support, spreads, commissions, and deposit and withdrawal options. By following these guidelines, you can minimize the risk of fraud and protect your investment. Always remember that the best Forex broker is the one that meets your trading needs and provides a safe and secure trading environment.